Build or Buy? Criteria to help leaders make technology choices

3 Jun 2022

Matt LindopIt used to be simple. You need a piece of digital technology? Go to a vendor, then pick an integration partner expert in implementing the CMS. As technologies have matured however the idea of building more of the stack in-house, or assembling from a kit of parts, has become more feasible. Meanwhile the vendors themselves have been broadening and blending the scope of their individual solutions, playing for an ever greater share of the pie.

The choice for today's technology leaders considering whether to buy or build then is a complex one. Unfortunately, it's also one without a right answer either. When considering a build/buy question we apply a set of criteria to help stakeholders coalesce around a technology strategy. While not intended to be comprehensive these provide the 'guide rails' around which businesses can make an informed and considered choice.

Criteria 1: commercial objectives

As commercial consultants, we always start by fully understanding the underlying business case. In our experience it is all too easy to over estimate the potential upside of a technology choice/downside of doing nothing. Vendors can create the impression that not selecting their solution/any solution represents a stark commercial risk, where the reality is rarely this clear cut. It's also critical to consider total cost of ownership (TCO) in any build/buy decision, factoring in not just up front build costs but also those for ongoing support, licensing and training.

Criteria 2: scope & application

Not all digital technologies are equally mature. eCommerce platforms and content management systems, for example, have been around for a long time and are relatively mature domains. Innovation in these technologies is predominantly focused around componentisation - separating out the building blocks to enable greater flexibility and power, giving rise to headless platforms and powerful front end and middleware solutions. Conversely other technologies are less mature - order management systems, revenue management systems for example - and here innovation tends to focus on features and integrations.

How closely the target use case and technology overlap is a key consideration too. Shopify has been able to dominate global eCommerce because it is so perfect for the majority of small traders: the overlap between use case and feature sets is perfect. Where this is less true - for instance where products are digital, or membership/gated content is more important, the benefits of the more obvious vendors can be less compelling.

Criteria 3: capability & capacity

These days many organisations have significant in-house digital capabilities, eg in engineering, product management and design. While product and design resource is normally less affected by technology choice it is still important for these disciplines to understand the capabilities of bought platforms early. Engineering capability is a more complex consideration as we need to think about the specific skillsets of the engineering teams. Many organisations will have a reliance on legacy technologies, where more cutting edge platforms may demand capabilities. Looking at the problem the other way, the most widely available developers may want to work in Node.js and React, and a requirement for PHP developers (for instance) may limit the talent pool. There is also the question of what resource model suits the organisation best. While some large organisations will want to inhouse all disciplines, most in our experience favour a blend of internal capability supported by external capacity – either permanently or to support spikes.

Criteria 4: timing

Many businesses have peak trading periods that technology projects need to either hit or avoid. We frequently see projects targeting a pre-peak window that end up missing this deadline, often in the process diluting their own business case. While bought technologies offers the potential to go live sooner, the reality is that integration will often be a time consuming process. There are exceptions to this - where there is the opportunity to switch a legacy system for a highly mature and easily procured modern alternative we have seen software deployed within weeks that previously would have taken many months.

Criteria 5: business agility & competitive advantage

Analysis of the market and the customer behaviours can help identify business opportunities through technology choices. In their 2020 book 'Edge: Value-driven Digital Transformation' Highsmith, Luu and Robinson argue that three factors should be used when assessing individual pieces of technology:

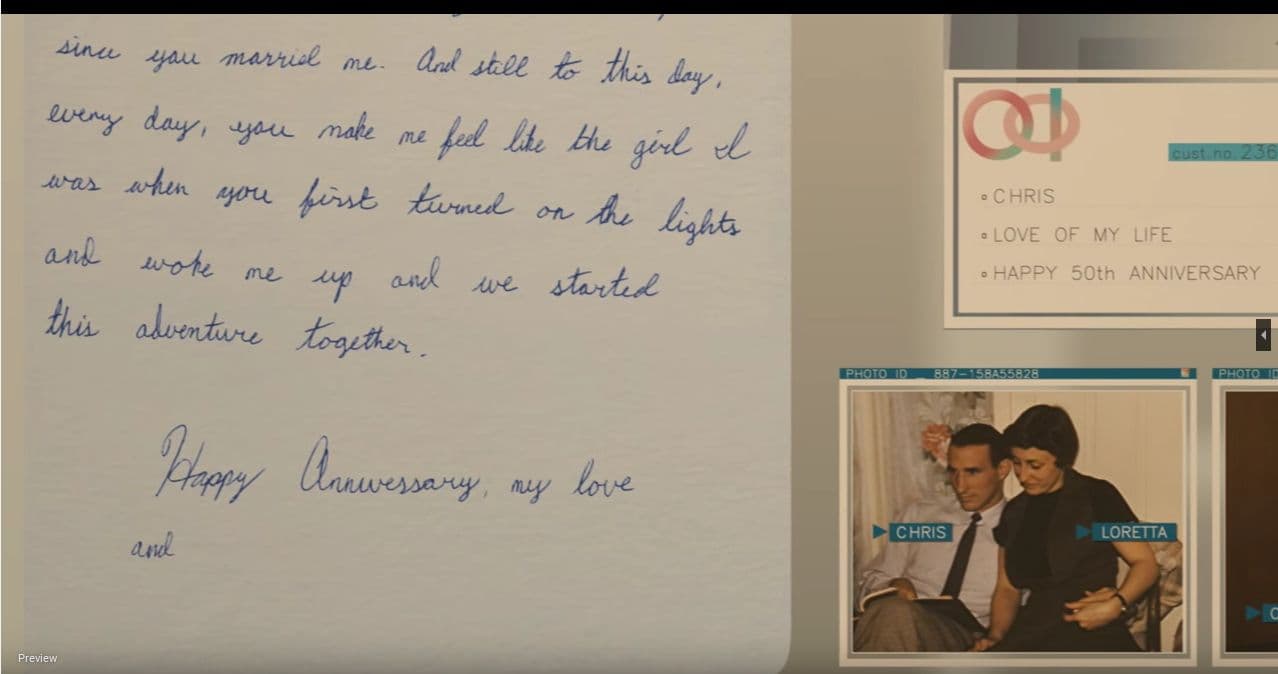

image

caption: p43 from Edge: Value-driven Digital Transformation, Highsmith, Luu & Robinson aspectRatio: 0.6

separator

height: 20

This kind of detailed analysis of the need state can often throw up interesting opportunities or considerations. For example one of our clients wanted to introduce a subscription model to their customer base. Many of the larger vendors could integrate with specialist third party subscription tools, but one had acquired one such tool, meaning integration was much simpler.

Criteria 6: ecosystem plays

The promise of the big vendors is that with one platform multiple need states can be satisfied, and multiple teams served through one cohesive and all pervading solution. Here the balance to be struck is between the convenience, power and procurement simplicity of one vendor, versus the flexibility and agility – and complexity – of maintaining and integrating multiple providers. Many organisations choose to buy several components from one platform but not the whole thing, and this can often be a pragmatic middle ground. Others may decide that any vendor so large that it can satisfy that many need states is both too expensive and amorphous to understand their specific business needs.

Wrapping up

Ultimately like so many business decisions that of whether to build or buy will often be made on the strength of past experience, what competitors have chosen to do and the nature of the technology and business need. By applying a set of criteria to the decision making process we are often able to give decision makers additional tools and considerations.